With the high rise of inflation and economic instability, It is obvious that saving money is one of the most difficult tasks to carry out right now. Do you know you can save money on a low income? As saving money might just be the most crucial key to your financial success.

No matter how small the amount seems, your commitment and drive and implementing the strategies shared in this piece will keep you motivated and focused.

I have shared 3 of the best methods to save money on a low income. This is a proven and tested method that can help you save more money, on a low income and how to save money fast.

Here are the strategies you need to create and grow your savings on a little income:

🎯 Track your expenses:

The best way to know where your money is going is to “track your expenses!”. Because tracking your expenses will allow you to see how your expenses align with your income. You can easily tell if you are spending your income in a way that allows you to maximize your savings. It is amazing what you will discover. And will be where is your money going?

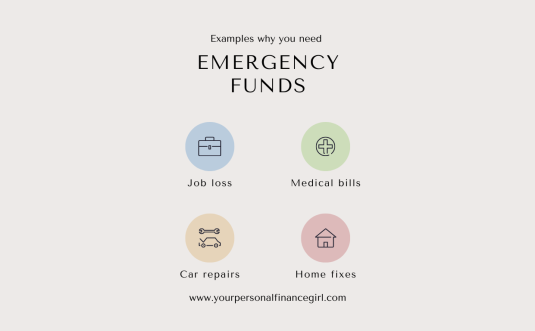

🎯 Cut your expenses in a way that your well-being is not affected

One of the popular recommendations out there is to cut your expenses in a way that your expenses; you have to know how to cut it so your well-being is not affected.

This way, you are able to identify the expenses that you don’t really need. And then you can channel those resources into savings.

🎯 Save First, Spend Later

Do you spend before you save? Typically people start off like this. They spend their income first with the hope of saving whatever is left after spending. But the truth is something will always come up that you will need to spend on, so you may never be able to save. The best strategy that works—only if you try it—is to take a predetermined amount and save it once you receive your income, then start spending only what is left especially if you have a low income.

Summarily, remember to save only what you can afford. You must have heard others say you should save 20% of your income. However, you do not have to take this since your income might not allow it. You can opt for something more convenient. But, you must ensure that you are consistent with any of the amounts that you decide to go with. Instead of choosing to save a big amount monthly only to stop after a few months just because you can no longer keep up, you are better off saving a lesser amount and building on it consistently every month. You will make your daily life a lot easier, and your savings will steadily grow.

Continue like this, stay committed and consistent, and you will be amazed to see how much your savings will grow!

Did you find this helpful?

Let me know and you can join my community for more content like this.

[…] you first need to know where your money is going. This means that you need to keep track of your expenses for at least a month. In order to get a sense of how much you are spending in different categories, […]

Yes, you are correct.

First of all I would like to say fantastic blog! I had a quick question in which I’d like to

ask if you don’t mind. I was interested to know how you

center yourself and clear your mind prior to writing.

I have had trouble clearing my mind in getting my thoughts out

there. I do enjoy writing however it just seems like the

first 10 to 15 minutes are lost just trying to figure out how to begin. Any recommendations or hints?

Many thanks!

No problem at all, thanks for the kind words, It takes me a while to finish my content as I do a lot of research, then jot done the sketch before publishing, when I get tired I do well to leave it get refreshed then continue this isn’t immediate though, it takes a while sometimes weeks.

Гарний пост, я поділився ним із друзями.

Дякую тобі

Belo post, compartilhei com meus amigos.

obrigada

[…] with online jobs is virtually limitless. With the right skills and work ethic, you can scale your income to match or even surpass your current salary. Online businesses and platforms such as e-commerce, […]