If you find it difficult to save money, I encourage you to read further, as I have carefully curated 10 money-saving techniques in this post. I understand that saving is hard. And it is quite challenging depends because of the current economic situation all over the world. In this particular piece, I’m going to share with you the most underrated money-saving methods that can help you save much more money than what you’re doing right now, with your current income, you can save money with whatever you earn, you can save money with your current situation.

So there are many ways to cut costs and build up your savings. And here are a few of the most underrated money-saving techniques and rules that can help you save;

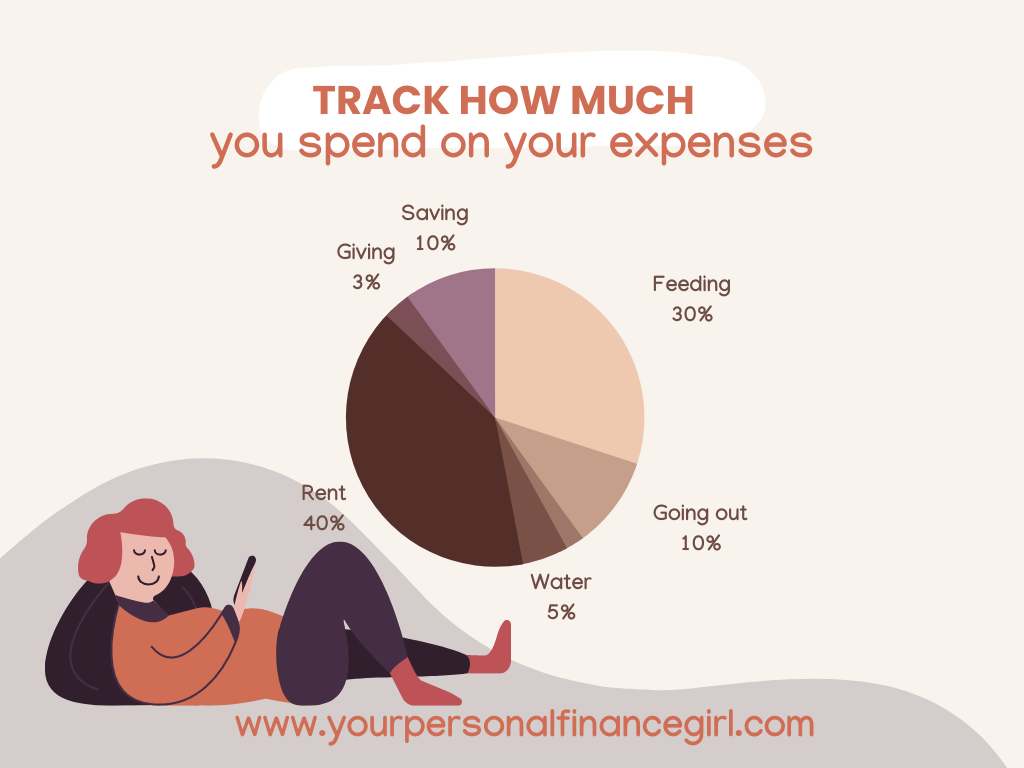

1. Track your spending

You want to save money but you don’t even know how much you are spending, how do you intend to save the money? How do you intend to get better when you don’t know the exact amount of money?

Tracking your spending is one thing you need to start doing right now. This would help you know where your money is going. And then you can better manage your expenses. There are several tools and methods to help you track your expenses. You could use a budgeting app or a spreadsheet, or an Excel sheet to track your expenses.

This exercise can help you identify areas to cut back on. If you are able to achieve this for a month, or up to three months, you can literally tell the patterns in how you spend your money. You can now answer the following question with the data you’ve gathered

Are you spending too much on eating out?

Do you spend too much on giving?

Are you spending too much on non-discretionary?

This exercise would help you to tell where exactly you want to cut back. Which makes it a very valuable money-saving techniques.

2. Go shopping with a list

To save more you need to make a list of items you need before going shopping. Surprisingly, you’d save a lot of money by doing this. It is actually important because this would help you to avoid impulse purchases.

You know how enticing the shopping malls are when you walk in. With all the products calling your attention and we begin to feel like, I need this, I need that. But in actuality, we don’t need them. Even though we feel like we do. Which leads to you buying those things and having buyer’s remorse afterwards.

To avoid this cycle that has been constant just go with a list, this would help you caution yourself when trying to buy items, not on your shopping list. You can also ask yourself if the items you are purchasing is because of impulse or because you genuinely need to get the item.

3. Avoid Sales

To save more money you need to stay away from sales. Yes. sales manager, you feel like a good way to buy items because things are cheaper. And then you can buy more and all of that. But guess what, prices are often marked up before the sales.

So when you’re seeing like, Oh, if he’s to present slash, imagine not be 50% slash might just be 10% Slash, meaning that you’re spending more money. So before you go ahead and buy that next item, what to do, or compare the prices and look for deals that are better and do not need the item before the sales, it actually means you did not need the items, you’re just trying to buy out that thing because you’re having the psychology of fear of missing out on that particular item because you feel like it’s cheap.

4. Make your own meals

Preparing your own meal is one money-saving technique that is often overlooked. Just planning your meals beforehand and cooking in bulk can save you a lot of money. It is also an avenue for your to bond and burns some calories in the kitchen. Save yourself some money going forward and plan ahead, buy in bulk and prepare your meals in bulk weekly, biweekly or monthly.

5. Use cashback apps

There are so many cashback apps that you can use to purchase items. When you purchase items for the original price, you get coupons or discounts when you want to shop again. This could save you a few bucks here or there. And that would help you to earn money on things that you are going to buy anyway.

There are so many cashback apps that you can use to purchase items. When you purchase items for the original price, you get coupons or discounts when you want to shop again. This could save you a few bucks here or there. And that would help you to earn money on things that you are going to buy anyway.

6. Purchase Pre-Owned items

This tip right here would help you save a lot of money while maintaining the quality of your life when you need to buy items or gadgets that you need. There are times when you really need an item but cannot afford to buy the brand-new version or would rather save some money on the brand-new item. buying pre-owned items does not mean you are compromising on the quality of what you are buying as some people sell off new items for different reasons. This could be because they need to clear off space or so they can make extra cash. Typically, this is a win-win for both parties. Going forward you can look for used/ refurbished products to buy instead of buying the new ones that can be really, really expensive when you compare the prices.

7. Prioritize your needs or your wants

To save more money, you would need to prioritize what are needs and wants are when it comes to your unique financial situation. Prioritizing your spending on necessities and cutting back on non-essential expenses. this involves asking yourself whether you need the next item you want to buy. Or do you just want it? Ask yourself this question before making that next Purchase. and you’d realize that this is one of the most crucial money-saving techniques yet.

8. Negotiate your bills

Cousin, do not be afraid to negotiate bills. I’m talking about bills from your phone bills, your light bills, and your water bill, you may be able to get a lower price from another vendor for the same quality. So you want to actually negotiate your bills from these providers to ensure that you’re getting the best deal out there for the best quality you can actually think of.

9. Shop at thrift stores

Yes, thrift shops can actually save you a lot of money on clothes, furniture, and household items, than you can actually imagine, so if you’re looking at ways to cut down on your expenses and your income is not enough. You want to try to buy things from these places. Remember that they are actually not bad. They’re just pre-owned, and some of these items are not even pre-owned, because they might have been cleared out from the shopping mall, as old stock and the stores need to restock.

10. Living below your means

Last but not least on my list of the most underrated money-saving techniques. Money Saving rule is that you should live below your means. This rule sounds like a broken record to me because I cannot express myself on this enough. When you have money when you have your income. Don’t go ahead spending above your income just because your friend can afford this thing you want to buy just because you feel like you can buy you go ahead. Remember the thing that you cut your quote, according to your material, not according to your size. So the sooner you start living below your means the better for your finances. And that way you can save more money than you end up investing that will bring you more money.

At the end of the day. You are building wealth that is better for you in the long run. And you get to have that day when you don’t have to work.

But you’re earning money cousin if you found this video useful or insightful, or you’ll be picking up one of these new ways to actually save money. So let me know in the comment section. And if you want me to write on a particular topic, do not hesitate to let me know as well. Remember that on this blog. All we talk about is money. Your personal finance girl is about teaching about your money from saving, investing, budgeting, and everything you can think about money is what we do on this channel.

Don’t forget to like, share, and subscribe, and I’m going to be seeing you in the next post.

Thanks for sharing. It’s so informative. God bless you richly